Griffin Funding, LLC aims to provide short term financing to under-served, qualified real estate operators and developers in North Jersey. Griffin has a team unparalleled in the private lending industry. Griffin’s pledge is to make the right loan to the right borrower on the right property.

Flip-Flop Loans

Griffin will provide a 6-12 month loan that will

allow borrowers to quickly reposition the

property. LTV will be structured for individual

deals with a maximum of 75% of the “after rehab value" of the collateral property.

Bridge Loans

Griffin will provide a 3-9 month bridge loan that

will allow borrowers to quickly close on a

property purchase. LTV will be structured for individual

deals with a maximum of 75% of the

“as stabilized” value of the property.

Flip-Flop Loans

There is tremendous demand for short-term real estate loans in North Jersey. This demand is driven by real estate borrowers looking to quickly buy, fix up, and sell properties selling at a discount. Banks have largely pulled back from giving investors the short-term loans needed to facilitate these transactions, leaving a big opportunity for specialty lenders like Griffin. Griffin's lending team has a unique mix of connections and experience that will enable Griffin to find, assess, and monitor these short-term loans.

Today’s low-interest rate environment has been challenging for investors, with high-yield public market debt returns hovering only around the mid-single digit range. Investors seeking higher fixed income returns must partner with lenders like Griffin's lending team who can source proprietary lending opportunities from under-served markets, while providing proper safeguards and risk mitigation mechanisms to investors.

OUR EXCELLENT LENDING TEAM

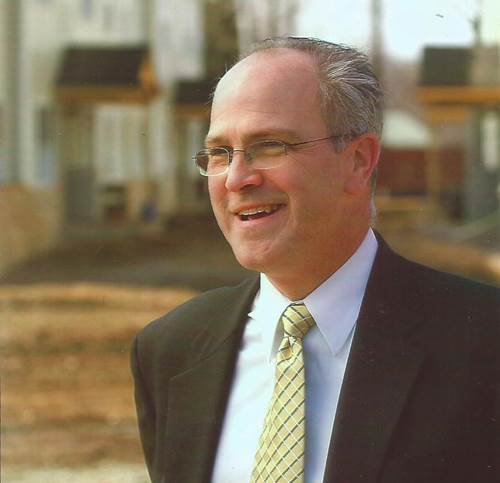

Glenn Miller III

Glenn has spent a career in commercial real estate lending spanning over four decades. As a banker he was involved in lending, whether as a credit analyst/underwriter, a lender, or on the management side of banking having run numerous lending groups. Executive titles he has held include Chief Credit Officer and Chief Mortgage Officer, both at local community banks. Glenn also spent four years in academia, teaching economics courses on commercial real estate at the university level.

Tyler Hall

Tyler has worked in lending for most of his 25 -year career. Tyler has been involved in the day to day operations of numerous New Jersey based banks including Midlantic, PNC, Investor Bank, Provident Bank and Spencer Savings Bank. Tyler has held roles in various capacities, from originating loans to approving loans to running lending departments, including most recently, the commercial loan group at Spencer Savings Bank.